Definition Of Equity Risk Premium

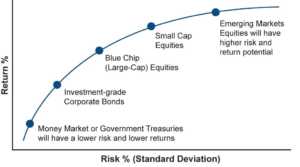

Investors expect to be compensated for the risk they undertake when making an investment. Equities over that of US.

Market Risk Premium Formula Example Required Historical Expected

Market Risk Premium Formula Example Required Historical Expected

Similar to a market risk premium equity.

/dotdash_Final_Calculating_the_Equity_Risk_Premium_Dec_2020-01-1ff6e59964b9408d9ac7d175f8ad1292.jpg)

Definition of equity risk premium. The equity premium puzzle refers to the inability of an important class of economic models to explain the average equity risk premium ERP provided by a diversified portfolio of US. The equity risk premium is an incentive which motivates risky investors to invest in high-risk assets. The equity risk premium may be calculated as the return such a stock actually earns over a given period.

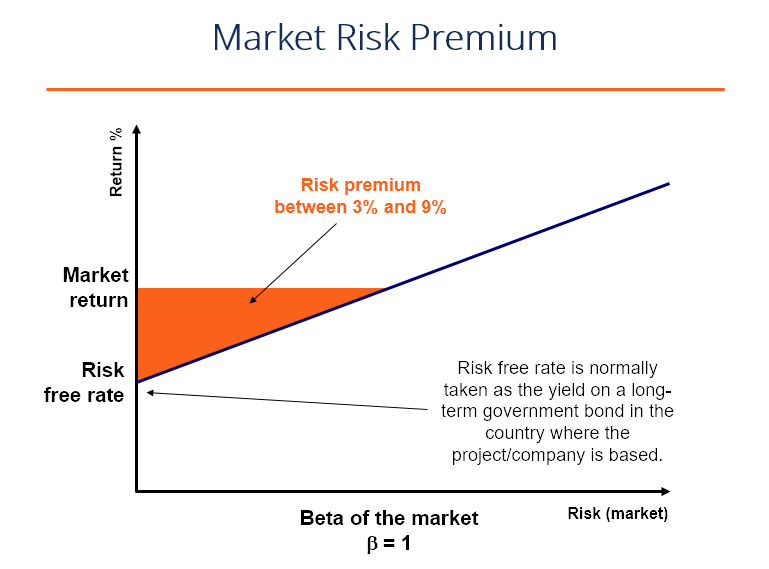

The equity risk premium is the premium investors expect to make. Market risk premium describes the relationship between returns from an equity market portfolio and treasury bond yields. It is used widely in finance and economics with the general definition being the expected risky return less the risk-free return as demonstrated by the formula below.

This comes in the form of a risk premium. This return compensates investors for taking on the higher risk of. Duff Phelps regularly reviews fluctuations in global economic and financial conditions that warrant periodic reassessments of ERP.

In simple words Equity Risk Premium is the return offered by individual stock or overall market over and above the risk-free rate of return. The equity risk premium is a long-term prediction of how much the stock market will outperform risk-free debt instruments. Since high-risk securities should have higher expected returns this is a fundamental principle in the financial theory with respect to portfolio management and asset pricing.

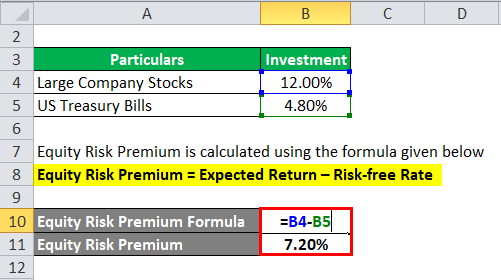

The equity risk premium is the difference between the rate of return of a risk-free investment and the geometric mean return of an individual stock over the same time period. Where is the risky expected rate of return and is the risk-free. Equity Risk Premium Equity Risk PremiumEquity risk premium is the difference between returns on equityindividual stock and the risk-free rate of return.

The risk premium reflects the. The Equity Risk Premium ERP is a key input used to calculate the cost of capital within the context of the Capital Asset Pricing Model CAPM and other models. Equity risk premium also called equity premium is the return on a stock in excess of the risk-free rate which must be earned by the stock to convince investors to take on the risk inherent in it.

Equity risk premium refers to the additional return from investing in a stock thats above the risk-free rate. The premium size depends on the level of risk undertaken on the particular portfolio and the higher the risk in. Since all investments carry varying degrees of risk the equity risk premium is a measure of the cost of that risk.

A risk premium is a measure of excess return that is required by an individual to compensate them for being subjected to an increased level of risk. How Does an Equity Risk Premium Work. Treasury Bills which has been observed for more than 100 years.

Recall the three steps of calculating the risk premium. Equity risk premium sometimes called simple equity premium is the additional return an asset generates above and beyond the risk free rate. Equity risk premium is an important input in determination of a companys cost of equity under the capital asset pricing model CAPM and its stock valuation.

Equity risk premium refers to rate of profit or return that can be earned on financial instruments above the average rate of return. Equity Risk Premium The return that an investor expects over and above the risk-free rate of return in exchange for investing in common stock instead of US. It is the compensation to the investor for taking a higher level of risk and investing in equity rather than risk-free securities.

An equity risk premium is an excess return earned by an investor when they invest in the stock market over a risk-free rate.

/dotdash_Final_Calculating_the_Equity_Risk_Premium_Dec_2020-01-1ff6e59964b9408d9ac7d175f8ad1292.jpg) Calculating The Equity Risk Premium

Calculating The Equity Risk Premium

Equity Risk Premium Learn How To Calculate Equity Risk Premiums

Equity Risk Premium Learn How To Calculate Equity Risk Premiums

What Is Risk Premium Definition And Meaning Market Business News

What Is Risk Premium Definition And Meaning Market Business News

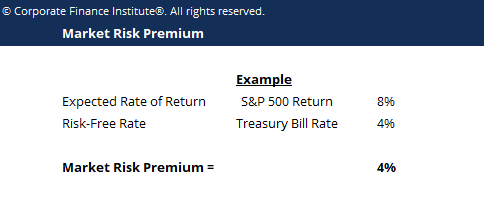

Market Risk Premium Definition Formula And Explanation

Market Risk Premium Definition Formula And Explanation

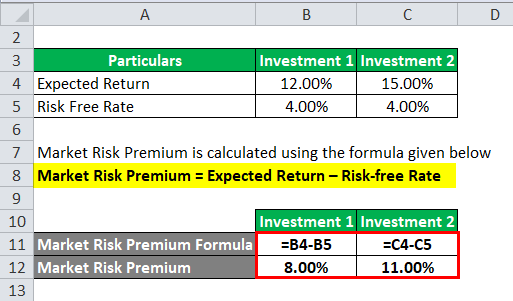

Market Risk Premium Formula Calculator Excel Template

Market Risk Premium Formula Calculator Excel Template

Market Risk Premium Definition Example

Market Risk Premium Definition Example

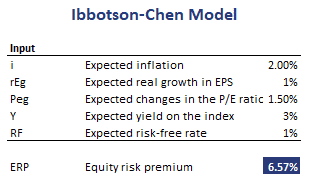

Equity Risk Premium Formula How To Calculate Step By Step

Equity Risk Premium Formula How To Calculate Step By Step

:max_bytes(150000):strip_icc()/dotdash_Final_Calculating_the_Equity_Risk_Premium_Dec_2020-03-9dc8f94135ff48b383262fafce26e82f.jpg) Calculating The Equity Risk Premium

Calculating The Equity Risk Premium

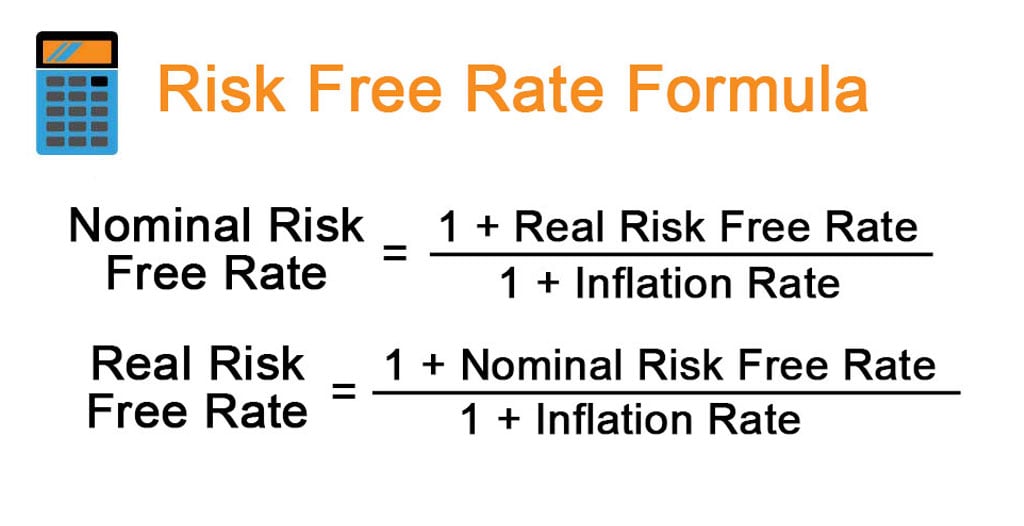

Risk Free Rate Formula How To Calculate Risk Free Rate With Examples

Risk Free Rate Formula How To Calculate Risk Free Rate With Examples

Market Risk Premium Formula Calculator Excel Template

Market Risk Premium Formula Calculator Excel Template

Market Risk Premium Definition Example

Market Risk Premium Definition Example

:max_bytes(150000):strip_icc()/dotdash_Final_Calculating_the_Equity_Risk_Premium_Dec_2020-05-7a8167292d2d46409d2828ea87053be2.jpg) Calculating The Equity Risk Premium

Calculating The Equity Risk Premium

Market Risk Premium Formula Calculator Excel Template

Market Risk Premium Formula Calculator Excel Template

Market Risk Premium Definition Formula And Explanation

Market Risk Premium Definition Formula And Explanation

:max_bytes(150000):strip_icc()/dotdash_Final_Calculating_the_Equity_Risk_Premium_Dec_2020-01-1ff6e59964b9408d9ac7d175f8ad1292.jpg) Calculating The Equity Risk Premium

Calculating The Equity Risk Premium

:max_bytes(150000):strip_icc()/dotdash_Final_Calculating_the_Equity_Risk_Premium_Dec_2020-06-acd73a07b27f4ea38d124481e271fe49.jpg) Calculating The Equity Risk Premium

Calculating The Equity Risk Premium

/dotdash_Final_Calculating_the_Equity_Risk_Premium_Dec_2020-01-1ff6e59964b9408d9ac7d175f8ad1292.jpg) Calculating The Equity Risk Premium

Calculating The Equity Risk Premium

Post a Comment for "Definition Of Equity Risk Premium"